Trinitee Latimer (12) jumped for joy when she received her acceptance email from her dream school, Xavier University of Louisiana. But she plans not to attend after all. On May 14, just one day prior to the commitment deadline, she still hadn’t received her financial aid estimate. On the 15th, she committed to Grambling State University instead.

“It’s depressing because this is my dream school and I’ve been planning this entire year,” Latimer said. “I didn’t want to [commit] and then get hit with a wave of financial debt I owe.”

This year, with the implementation of a new Federal Application for Federal Student Aid (FAFSA), the form that typically opens Oct. 1 was only available in January and was intermittently closed to new applications. Typically, FAFSA forms are processed by the time colleges release their decisions, but this year, many forms were not available to schools until close to the deadline for accepted students to commit.

For Latimer, the late submission created stress and uncertainty over whether her form was being processed on time.

“It was really frustrating when [the application] said it was going to open on this day and then it wasn’t until months later when I finally [was able to complete] it,” she said. “Then, it took forever to process. I submitted it in January, and it didn’t get processed until May. I was hearing back from schools and they were like, ‘I don’t see your FAFSA,’ and it wasn’t processed.”

The delay caused colleges to receive the form and send aid packages to students later than usual, and lateness varied by school and individual. While in previous years, students were expected to know where they would be attending college in the fall by May 1, colleges across the country extended their commitment deadlines to May 15 or later.

Donna Mahmoudi (12) said her decision about which school to commit to would have been different if she had known all her financial aid offers earlier.

“I didn’t get my financial aid package for Point Loma [Nazarene University] until after I had already [financially] committed to Case Western Reserve,” Mahmoudi said. “It would have affected my decision because I got way more money than I thought I was going to get. It was frustrating.”

For Sara Al Jaser (12), submitting her form was straightforward, but her financial aid estimate came late. Al Jaser was deciding between committing to UC Santa Cruz and UC Riverside, and her estimate for UC Santa Cruz arrived May 14 — the day before her deadline to commit.

“It was super stressful because I couldn’t pick a school until I knew my financial aid situation,” Al Jaser said. “[It was inconvenient because] I need time to find a roommate and I need time to be able to get to know the program. Even though I wanted to go to UC Santa Cruz more, I already knew how much aid [UC Riverside] was giving me, and if it was going to get down to it and they were going to take too long to do my aid, I was going to commit to Riverside.”

Rachel Huang (12) also waited up until her deadline to commit before she received a financial aid offer from the school she now plans to attend, UC Irvine.

“It was stressful to know that the deadline to commit was coming up and I didn’t have my decision because I needed to see the numbers before I could do anything,” Huang said.

As a first-generation college student, Huang felt that she was already very unsure about the process of applying to college. Her late FAFSA only added to that uncertainty.

“My parents came from China so they never had this form at all, so it’s kind of a shot in the dark,” Huang said.

Al Jaser said that the communication with schools about financial aid offers was obscure and difficult to navigate on top of the wait.

“One time I did call and I was on hold for two hours,” Al Jaser said. “By the time they answered they were like, ‘[the form] already came out’ and when I checked it wasn’t out and I had to call the next day and wait all over again.”

Latimer said she hopes that future classes experience a smoother experience with FAFSA and college commit deadlines than she and her peers have.

“I was trying to avoid financial aid being all over the place this year,” she said. “I hope next year’s students have it a little bit better than I did.”

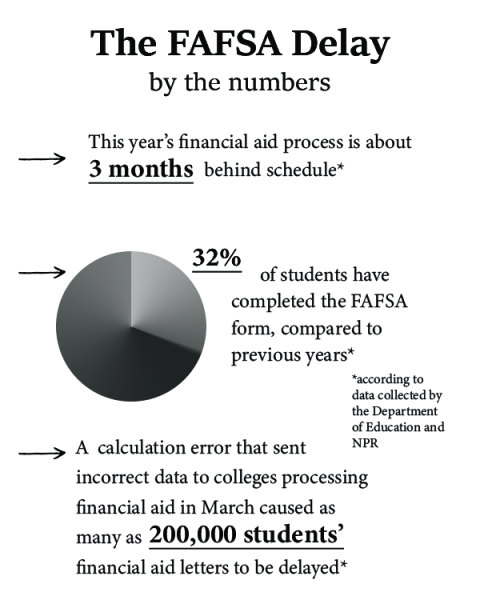

Potential stats for graphic:

- While each year, about 17 million students typically submit the FAFSA form, only about 5.5 million (~32%) have been able to fill it out so far (Dept. of Education)

- The financial aid process is about 3 months behind schedule (NPR)

- A calculation error that sent incorrect data to colleges processing financial aid in March caused as many as 200,000 students’ financial aid letters to be delayed (Dept. of Education)

![Jolie Baylon (12), Stella Phelan (12), Danica Reed (11), and Julianne Diaz (11) [left to right] stunt with clinic participants at halftime, Sept. 5. Sixty elementary- and middle-schoolers performed.](https://wvnexus.org/wp-content/uploads/2025/09/IMG_1948-800x1200.png)